The meme cryptocurrency PEPE saw its price spike over 12% this week, reviving speculative hype around the previously fading altcoin. After months of declining value, PEPE attracted renewed trader and whale interest with heavy buying volume emerging.

However, fundamental doubts remain about meme token sustainability, with critics arguing PEPE lacks underlying utility. Its recent pump illustrates the fickle nature of sentiment-driven cryptocurrencies.

Speculators Pile Back Into Volatile Meme Token

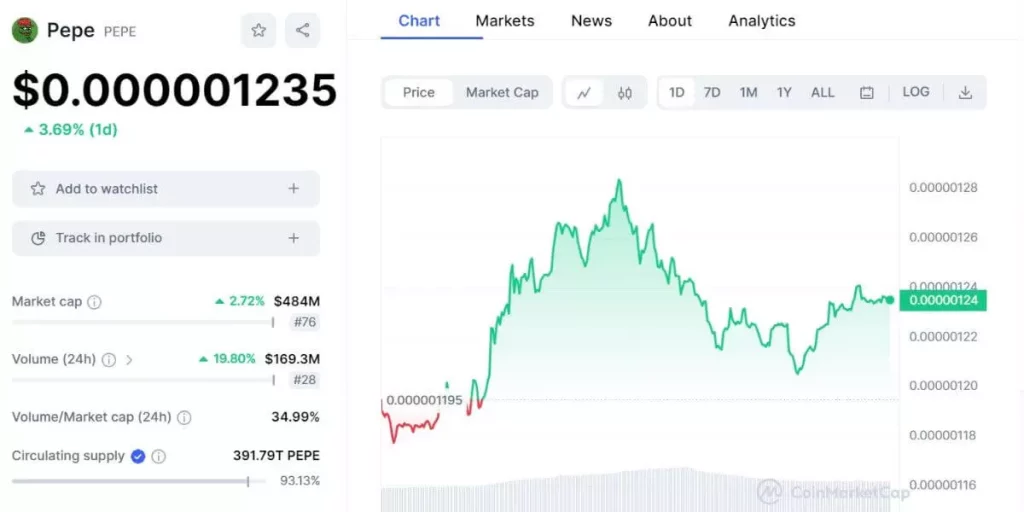

PEPE erased months of declining prices by suddenly surging double-digit percentages on August 9th. PEPE rose from $0.00000115 to $0.00000130 in 48 hours, its highest price since mid-June.

Trading activity also exploded in tandem, with volumes exceeding $200 million compared to just $50 million days prior. This was driven by an influential whale purchase of over 800 billion PEPE worth $1 million as enthusiasm re-emerged.

Meme tokens like PEPE skyrocketed in popularity last year alongside Dogecoin and Shiba Inu. But most including PEPE suffered steep declines in 2022 as crypto sentiment turned bearish. Its recent resurgence revives meme mania, but skepticism remains. Pepe Token Meme Coinmarketcap

Newfound Hype Still Below Previous Peak

Despite the pronounced bounce, PEPE remains far from its all-time high. At the peak of meme coin mania in 2021, PEPE hit $0.00000431 for a market cap nearing $2 billion. Its recent pump only brings PEPE back to early 2022 levels.

Nonetheless, any positive price movement stands out against the backdrop of broader crypto market doldrums in 2022. Speculators seem hungry to capitalize on the slightest indication meme hype could again deliver windfall gains.

This presents opportunity but also danger for those caught up in pump and dump cycles. PEPE clarifies its sole purpose is entertainment with no inherent value.

Questions Around Meme Coin Fundamentals and Sustainability

Unlike cryptocurrencies like Bitcoin and Ethereum with real-world utility, meme tokens depend entirely on community sentiment and internet trends. They intentionally lack roadmaps, formal teams, or technological innovation.

Experts argue this lack of fundamentals raises concerns over the long-term sustainability of meme cryptocurrencies like PEPE. Their prices fluctuate heavily based on hype and social media chatter rather than delivering services.

Once the zeitgeist fades, meme cryptocurrencies often fade back into obscurity just as quickly as they exploded in popularity. This presents challenges to sustaining growth outside speculative spikes tied to changing cultural winds.

A whale spent 1M $USDC to buy 807B $PEPE at $0.000001239 7 hrs ago after the price of $PEPE increased.https://t.co/P03KsDrzFi pic.twitter.com/0hjW6ewDjp

— Lookonchain (@lookonchain) August 9, 2023

PEPE’s Price Soared Thanks to Its Inclusion in Binance: Will It Continue to Rise?

Memes Remain a Gateway to Mainstream Crypto Adoption

However, proponents counter that even if ephemeral by nature, meme tokens still provide a crucial gateway for ordinary internet users into cryptocurrencies. Platforms leverage memes’ universal appeal and humor to drive curiosity and engagement.

Data showed PEPE attracted swaths of new investors during its latest spike as users were drawn in by the friendly meme concept versus more complex coins. As onramps, meme cryptocurrencies fuel overall web3 adoption despite doubts surrounding their viability as long-term assets.

Conclusion

PEPE’s +12% price breakout demonstrates meme cryptocurrencies remain capable of generating irrational speculative hype and windfall gains for holders during sudden bursts of momentum. However, meme token volatility exemplifies why experts advise caution around assets lacking fundamental utility or value.

While surges like PEPE’s may attract new adopters, sustainability is uncertain once trends shift or early buyers exit. Meme cryptocurrencies provide both huge opportunity and outsized risk inherent to their reliance on community sentiment over substance.

FAQs

What caused PEPE’s recent price spike?

A large purchase by an influential whale ignited renewed meme token speculation. Social media and community chatter likely also contributed to the surge.

How high could PEPE’s price go?

In 2021 it reached an all-time high around $0.00000431 during peak meme coin mania. It could retest old highs but would require another massive speculation wave.

What is the risk of buying meme cryptocurrencies?

Lacking real utility, they depend on hype and internet trends. Crashes can happen just as fast as gains once sentiment shifts. The high volatility makes investing dangerous.

Do meme coins help crypto adoption?

Their humor and social marketing can catalyze mainstream interest more easily than complex assets. But adoption is often superficial, focused on speculation over real use.

Can PEPE’s rally continue?

It could if momentum and hysteria build, but just as easily recede if whales cash out and traders move on. Without fundamentals, meme cryptocurrency prices are unpredictable and likely unsustainable.

WARNING: This is an informational article. Geek Metaverse is a media outlet, it does not promote, endorse or recommend any particular investment. It is worth noting that cryptoasset investments are not regulated in some countries.

Follow us on our social networks and keep up to date with everything that happens in the Metaverse!

Twitter Linkedin Facebook Telegram Instagram Google News Amazon Store